FACTS about Hospital Group Purchasing Organizations (GPOs)

"We find greedy men, blind with the lust for money, trafficking in human misery."

Attorney General Thomas C. Clark

Address before the Boston (MA) Chamber of Commerce, October 8, 1947

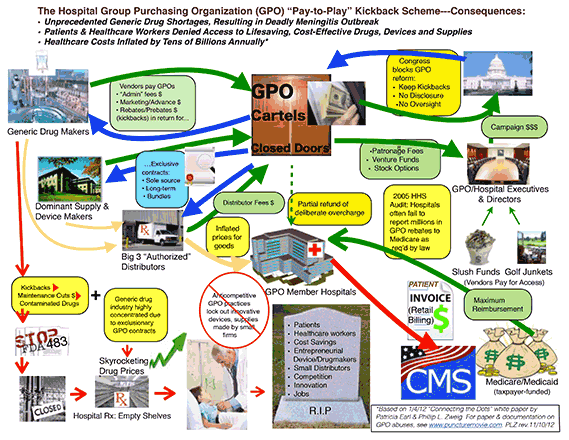

- These purchasing cartels, which negotiate contracts for an estimated $250 billion+ in goods annually for more than 5,000 hospitals and other healthcare facilities, are allowed to receive billions in kickbacks from suppliers — thanks to an obscure 1987 federal statute called the Medicare anti-kickback "safe harbor." In return, the suppliers get exclusive access to these facilities. In virtually every other U. S. industry, such kickbacks carry criminal penalties.

- Under this "pay-to-play" scheme, purchasing agents — not physicians and nurses — decide which medical devices, supplies and even drugs clinicians can use to care for their patients. Patients and workers are therefore denied access to better, safer and more cost-effective products — everything from safe needles to bandages, implants, pacemakers, oxygen monitors, surgical towels, even cancer medications. What matters most to the GPOs is the size of the kickback, not the quality of the product.

- Although GPOs were originally established to obtain volume discounts for member hospitals, in fact they do precisely the opposite. An October 2010 analysis by Navigant Consulting revealed that GPO kickbacks inflate annual healthcare costs by as much as $37.5 billion, including about $17.3 billion in taxpayer outlays for Medicare and Medicaid. Because GPO revenue is based on a percentage of sales, higher prices for goods generate more money for GPOs — and higher bills for Medicare/Medicaid.

- Despite attempts at reform by a few Members of Congress, nothing has changed. This scandal — the healthcare industry's version of the corrupt Wall Street practices that led to the global financial crisis — festers because of industry campaign contributions and collusion among hospitals, GPOs, big healthcare suppliers and policymakers.

| Rank | GPO | Location | Annual Purchasing Volume (APV) |

|---|---|---|---|

| 1 | MedAssets | Alpharetta, GA | $48.0 BB |

| 2 | Novation LLC | Irving, TX | 43.0 BB |

| 3 | Premier Inc. | Charlotte, NC | * |

| 4 | HealthTrust | Nashville, TN | 21.2 BB |

| 5 | Amerinet Inc. | St. Louis, MO | 8.0 BB |

| Source: Healthcare Purchasing News research October 2012 Based on self-reported purchasing volumes and educated estimates * Premier declined to disclose its annual purchasing volume |

|||

For Detailed Information

See "Dirty Medicine" at washingtonmonthly.com/archives, "Medicine's Middlemen" series at nytimes.com; gporeform.org; safeneedles.org; and Sethi, S. Prakash. Group Purchasing Organizations: An Undisclosed Scandal in the U. S. Healthcare Industry. (Palgrave/Macmillan 2009); and 60 Minutes, Needles. Feb. 25, 2001.